Ach Processing Things To Know Before You Get This

Table of ContentsThe Best Guide To Ach ProcessingAch Processing - TruthsThe 8-Minute Rule for Ach ProcessingThe Basic Principles Of Ach Processing The Single Strategy To Use For Ach Processing

Straight repayments can be made use of by individuals, businesses, as well as various other organizations to send out money. As an example, if you're paying a costs online with your checking account, that's an ACH straight payment. Social settlement apps such as Venmo as well as Zelle additionally use the network when you send out cash to pals and also family.The person or entity receiving the money registers it in their bank account as an ACH credit. Using ACH transfers to pay bills or make person-to-person repayments provides a number of benefits, beginning with comfort.

Not to mention you can conserve on your own a couple of dollars by not needing to invest cash on stamps. Furthermore, an ACH repayment can be a lot more safe and secure than various other types of repayment. Sending and receiving ACH payments is usually quick. The negotiation of a purchase, or the transfer of funds from one financial institution to an additional by means of the ACH Network, typically occurs the next day after it is initiated.

The smart Trick of Ach Processing That Nobody is Discussing

ACH transfers are far more cost-efficient when contrasted to wire transfers, which can range in between $25 to $75 for worldwide outbound transfers. Cable transfers are known for their rate and are usually utilized for same-day solution, however they can sometimes take longer to finish. With an international cable transfer, as an example, it might take several organization days for the cash to relocate from one account to another, after that one more few days for the transfer to clear.

There are some potential disadvantages to remember when utilizing them to relocate money from one bank to one more, send out settlements, or pay bills. Numerous banks enforce limitations on just how much cash you can send through an ACH transfer. There may be per-transaction limitations, everyday restrictions, and also monthly or weekly limits.

Fascination About Ach Processing

Or one type of ACH deal might be unlimited however an additional may not. Banks can likewise enforce limits on transfer destinations. If you go over that limitation with numerous ACH transfers from savings to an additional bank, you might be struck with an excess withdrawal fine.

When you choose to send out an ACH transfer, the moment frame matters. That's since not every financial institution sends them for financial institution handling at the very same time. There might be a cutoff time by which you need to get your transfer in to have it processed for the next service day.

ACH takes approximately one to 3 organization days to finish and also is considered slow in the era of fintech and immediate repayments. Same-Day ACH processing is growing in order to resolve the slow service of the common ACH system. Same-Day ACH quantity increased by 73. 9% in 2021 from useful reference 2020, with an overall of 603 million repayments made.

3 Simple Techniques For Ach Processing

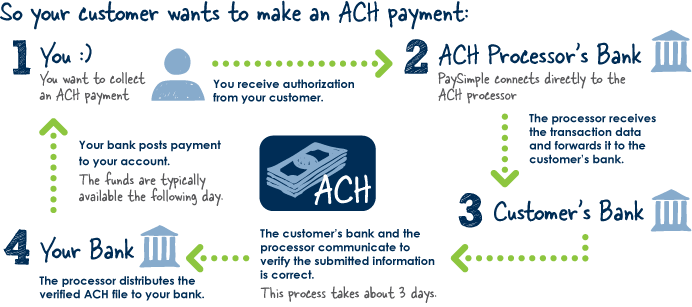

An ACH bank transfer is a digital payment made between financial institutions for repayment objectives. ACH bank transfers are made use of for many objectives, such as direct deposits of incomes, debts for routine payments, as well as cash transfers.

Both cable transfers and ACH transactions are utilized to promote the movement of money. Cable transfers commonly occur on the same day as well as set you back even more. ACH transfers generally take longer to complete; however, same-day ACH transfers are ending up being original site a lot more usual - ach processing. ACH is additionally for residential transfers whereas international transfers are done by wire transfers.

The 8-Minute Rule for Ach Processing

Regardless, ensure you understand your financial institution's plans for ACH direct deposits and also straight repayments. Also, be watchful for ACH transfer scams. A typical scam, for example, entails a person sending you an email telling you that you're owed cash, as well as all you need to do to receive it is give your savings account number and transmitting number.

Editor's note: This post was first released April 29, 2020 as well as last updated January 13, 2022 ACH represents Automated Cleaning House, a united state financial network made use of for electronic payments as well as money transfers. Also referred to as "straight payments," ACH payments are a method to transfer cash from one savings account to an additional without utilizing paper checks, charge card networks, cable transfers, or cash.

As a consumer, it's most likely you're currently acquainted with ACH payments, even though you may not be conscious of the lingo. If you pay your costs electronically (instead of composing a check or going into a credit rating card number) or get direct down payment from your company, the ACH network is possibly at job.

Comments on “About Ach Processing”